Exploring the Pine Labs Platform : Queens of Disaggregation

Continuing from last week, this week I will be continue to expand on the model for Pine Labs.

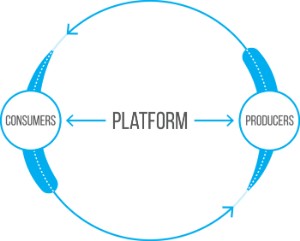

A platform must address the needs of at least two or more communities that interact on it. We discussed last week that about six parties are involved in a payment regarding a purchase via credit/debit card, namely:

1. Buyer: Uses a Credit/Debit Card for Purchase

1. Buyer: Uses a Credit/Debit Card for Purchase

2. Bank/Financial Institute that has issued the Credit Card

3. Bank/Financial Institute that has issued the Point of Sale (PoS) Machine (Card Swipe Device or App)

4. Visa or MasterCard or equivalent Settlement Provider

5. Merchant or Retailer who is selling the product or service to the Buyer

6. The Vendor that produces the product in the first place, represented by a distributor in some cases

Last week we explored the benefits that the Pinelabs platform brings to the Merchant. This week we will explore the benefits they bring to the Banks that sell the PoS machines.

As discussed last week, it is beneficial for the bank to have more and more merchants have their PoS, but the cost of the machines, the maintenance and operations cost, the cost of sales etc. limits their “Reach” in two ways;

They cannot afford an unlimited sales team, so they are limited by physical reach

They need a minimum revenue guarantee for the business case to become positive, so they are limited by a threshold

They cannot endlessly integrate into the new systems & suppliers for various schemes and are limited in creating new business streams

Pinelabs solves these problems for them, as their salesforce complements the Banks sales force in helping them get more footprint, by disaggregating the machine and the bank profile, once the bank profile is integrated with Pinelabs platform, the Pinelabs sales team can help bring new merchants on-board more without field sales involvement.

Since the cost of sales is lesser and does not even involve buying and supplying PoS machines, the business case becomes much simpler and the threshold for creating a new merchant profile goes a lot lower, helping them cast a much wider net and expand their revenue potential.

The more their footprint spreads, the more chance of their own card being swiped on their own machine, meaning more in-house transactions and more profit share for self.

So you see they help the Banks as well!

There are other ways they help the Banks, but we will explore them in conjunction with the Vendors, next week as I elaborate a scenario using a specific example. So stay tuned.